CSRD & Sustainability Reporting: What Companies Need to Know

Understanding EU’s CSRD: Find out about the essentials of the Corporate Sustainability Reporting Directive and what companies can do to comply with it.

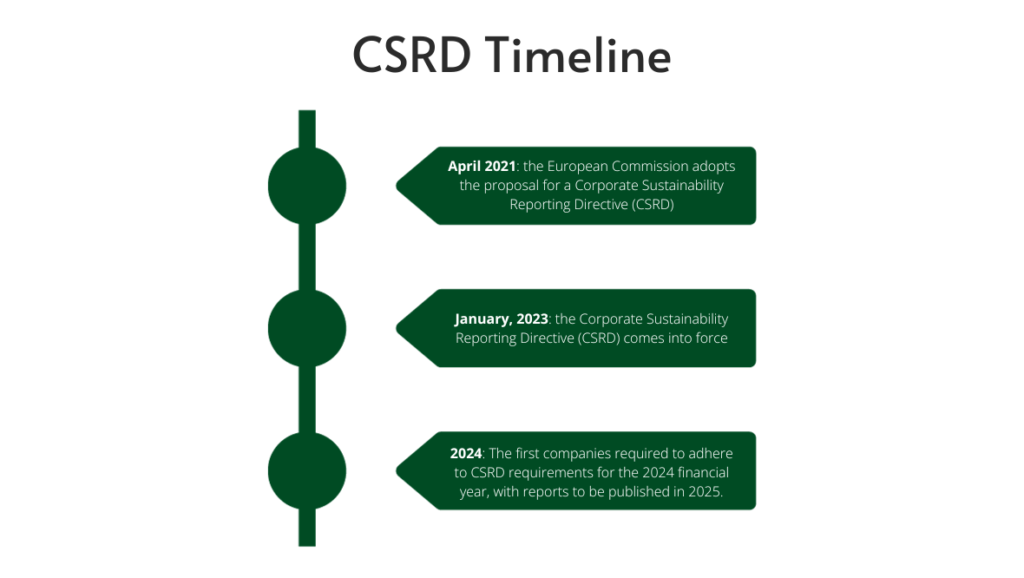

The EU Corporate Sustainability Reporting Directive (CSRD), which came into force on January 5, 2023, will significantly overhaul the landscape of sustainability reporting within the European Union. This comprehensive directive aims to strengthen the reporting requirements for large companies and introduce significant measures that will help propel the EU’s transition toward a sustainable economy.

By broadening the scope of reporting companies and strengthening reporting requirements, the CSRD aims to empower investors, stakeholders, and the public with comprehensive information about companies’ environmental, social, and governance (ESG) performance. This enhanced transparency will foster responsible business practices, promote sustainable investments, and contribute to a more environmentally conscious and equitable European economy.

This article explores the fundamental elements of the EU Corporate Sustainability Reporting Directive (CSRD) such as its scope, standards, and audit requirements as well as provides tips on what companies can do to comply with it.

Corporate Sustainability Reporting Directive (CSRD) in Action

The Corporate Sustainability Reporting Directive (CSRD), broadens the scope of companies required to report on their sustainability performance, extending the mandate to include larger and listed small and medium-sized enterprises (SMEs). This enhanced reporting will empower investors, stakeholders, and the public to make informed decisions based on a comprehensive understanding of companies’ environmental, social, and governance (ESG) performance.

By harmonizing reporting standards and streamlining the reporting process, the CSRD aims to reduce reporting costs for companies over the long term, while also ensuring that investors have access to the necessary information to assess financial risks and opportunities related to sustainability issues. The first companies will be required to adhere to the new CSRD requirements for the 2024 financial year, with reports to be published in 2025. This phased approach will allow businesses to adapt to the new guidelines effectively while ensuring a smooth transition towards a more sustainable and transparent corporate reporting environment.

‘The CSRD proposal is a prime example of policy coherence between investor and corporate disclosure obligations, building an end-to-end disclosure framework that will enable investors to scale up their contribution to the EU Green Deal and wider sustainability goals.’

Investor Statement of Support for EU Corporate Sustainability Reporting Directive

Principles for Responsible Investment (PRI)

Elements of CSRD

Scope

The EU Corporate Sustainability Reporting Directive (CSRD) will apply to a wide range of companies, including all “large companies” and those listed on EU stock exchanges, excluding micro-companies. A “large company” is defined as:

- Having more than 250 employees

- Holding a balance sheet total of at least €20 million or a turnover of at least €40 million

- Being publicly traded or operating as an insurance company or banking organization

While listed small and medium-sized enterprises (SMEs) are also subject to the CSRD, they will have a grace period of three years before they are required to comply with its full reporting requirements. Approximately 50,000 companies across the EU are expected to fall under the CSRD’s scope.

Sustainability Reporting Standards

The European Financial Reporting Advisory Group (EFRAG) is spearheading the development of a comprehensive set of European sustainability reporting standards. These standards build upon existing frameworks like GRI, SASB, and CDP, while aligning with existing EU regulations.

The new standards provide a holistic framework for sustainability reporting, emphasizing critical factors such as double materiality, encompassing both financial and non-financial impacts. They also focus on the long-term sustainability efforts and strategies of companies, their environmental footprints, and their commitment to diversity and inclusion.

To cater to the specific needs of small and medium-sized enterprises (SMEs), a toned-down version of the standards will also be developed, streamlining reporting requirements while ensuring that SMEs can effectively communicate their sustainability performance.

Sustainability Reporting Assurance (Audit)

While reporting under CSRD businesses will have to get their sustainability information verified from a statutory auditor, who will have to give an opinion on the compliance of the information to EU requirements on the basis of ‘limited assurance’.

As per the CSRD proposal ‘This opinion should cover the compliance of the sustainability reporting with Union sustainability reporting standards, the process carried out by the undertaking to identify the information reported pursuant to the sustainability reporting standards and compliance with the requirement to mark-up sustainability reporting.’

Limited assurance means a less rigorous version of reasonable assurance, wherein fewer tests and checks are applied to verify the information.

What can companies do to prepare for CSRD?

Looking at the changes that will follow with the implementation of the new sustainability reporting standards and CSRD, companies can already start planning for the future by:

- Establish robust ESG assessment processes: Integrate in-house mechanisms for systematically evaluating and analyzing the company’s environmental, social, and governance (ESG) performance. This involves gathering and analyzing relevant data, identifying material issues, and assessing the company’s impact on stakeholders and the environment.

- Cultivate a comprehensive sustainability strategy: Formulate a strategic roadmap that aligns the company’s sustainability objectives with its overall business goals. This strategy should encompass short-term targets, long-term aspirations, and a clear action plan for implementing sustainability initiatives.

- Adopt internationally recognized sustainability reporting standards: For companies that do not yet report on sustainability but will fall under the CSRD scope, to already begin reporting at a fundamental level using internationally recognized standards. For instance, using GRI standards for core sustainability reporting or GHG Protocol standards for emissions reporting.

- Gather and organize sustainability data: Establish robust data collection and management processes to gather, organize, and analyze relevant ESG data. This includes ensuring data accuracy, consistency, and alignment with the adopted sustainability reporting standards.

- Leverage technology for effective sustainability reporting: Employ technology solutions to automate data collection, streamline reporting tasks, and enhance data analysis capabilities. This can significantly improve efficiency and reduce reporting time.

- Build internal expertise and capacity: Invest in training employees on sustainability reporting principles, methodologies, and technologies. This will foster a culture of sustainability within the organization and enhance the ability to produce high-quality sustainability reports.

- Engage with stakeholders and external parties: Establish open communication channels with stakeholders, including investors, customers, and regulatory bodies, to gather feedback on sustainability initiatives and demonstrate transparency.

- Continuously monitor and evaluate performance: Regularly review and evaluate the company’s sustainability performance against its goals and targets. This continuous improvement approach will ensure that the company remains on track and adapts to evolving ESG trends.”