EU Carbon Tax – What, Why and How Will It Impact My Business?

What does the EU carbon tax mean for businesses?

The carbon tax has been a subject of a lot of discussions lately. But what does this emissions tax entail in its essence, why is the discussion relevant today more than ever, and what are the potential political impacts of enforcing the tax?

What is an emissions tax in general? How is such a tax defined and implemented?

Carbon taxation means that a government starts taxing entities that cause carbon emissions as a part of their operations. The idea behind carbon taxation is to discourage causing carbon-intensive operations and to encourage corporations to innovate and to adopt new processes resulting in smaller carbon emissions.

Even if an emissions tax is paid directly by the producers, it is intended to work also as an indirect tax for consumers, thus guiding consumer behavior towards more climate-friendly options.

Indirect taxation of emissions

Once a producer pays the tax in the production process, they will pass on the increased cost by increasing the price of the product, and in that way decrease the consumer demand of the emission-heavy product, as a result of the price increase.

As a result of carbon taxation, businesses and consumers will adapt their behavior, for example by utilizing new technologies or by switching fuels. Also, green businesses on the market will benefit greatly from being able to offer climate-friendly options and solutions at a notably lower price than their carbon-heavy competitors.

Different ways of carrying out an emissions tax

There are mainly two distinct ways of implementing a carbon tax. The first option is to set a tax for emissions-intensive products, such as gasoline or for coal. The other way is to set a tax for each entity based on the amount of carbon dioxide equivalents they emit within a given time period. Both ways of implementing a carbon tax are potentially useful in cutting the total amount of emissions, and they could also be used together as a combined approach.

The reason why a carbon tax is suddenly a hot button issue right now

In 2021 EU announced its “Fit for 55” climate change mitigation package, which also included a plan for a carbon tax. Even if most of the climate change mitigation plan has to do with intra-EU solutions for redesigning the existing systems, the carbon tax was an item on the list of intended reforms that shook up the international political scene.

What does the EU carbon tax mean for businesses in practice?

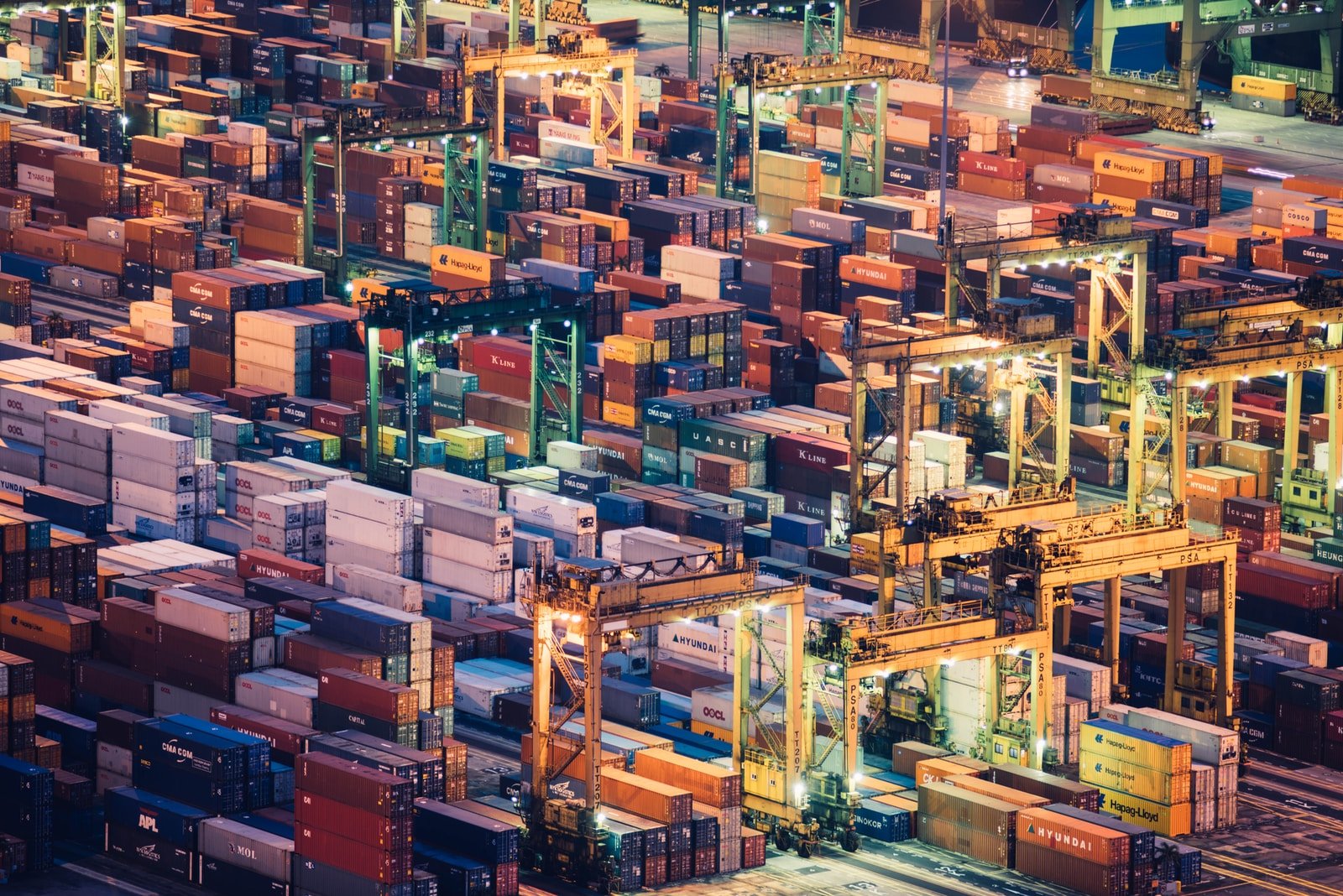

The greenhouse gas emissions levy that is being currently drafted would apply to a select group of particularly emissions-intensive imports, such as steel, aluminum, cement, fertilizers, and electricity.

The carbon tax would not just be limited to intra-EU producers paying a tax based on their emissions, but also that goods imported from third countries would be subjected to a similar tax before being allowed to enter the single market area. The objective of the border tax is, that it would start applying step by step between 2023-2025 and be fully implemented from 2026 onwards.

This would ensure, that European domestic production does not suffer unfairly from competition from countries without an emissions tax. Other countries that will be most likely especially affected by the upcoming carbon tax regulation include China, Russia, Turkey, the UK, Ukraine, South Korea, and India.

Many of the affected countries see the carbon dioxide levy as a protectionist measure in order to boost the European internal market by punishing the economies that produce a significant portion of imports consumed in the EU area. However, the motivation that the EU states to be the driving force, is that if the EU implements a carbon tax for its imports, it will encourage also other countries to follow suit as soon as possible.